Galvanized steel coil prices in 2025 keep changing a lot. More coils are being sent to other countries. From January to May, exports reached 8.6 million tons. This is 45% of what experts think will be sold this year. If this keeps going, exports could reach 19.8 million tons in 2025. That would be more than last year. The market depends on many things. High interest rates and problems with supply chains made making coils cost more. These things also made prices go up and down.

Our company thinks supply limits, raw material costs, and energy prices matter most this year.

Key Takeaways

Galvanized steel coil prices change a lot in 2025. This happens because of raw material costs and supply chain problems. You should stay updated to make smart buying choices.

The market for galvanized steel coil will grow a lot. It may reach about $105.7 billion by the end of 2025. This is because more people want it for construction and cars.

Asia-Pacific is the top market. It makes up over 58% of the demand. Companies there are growing fast, so watch what happens in that area.

Energy prices and raw material costs affect galvanized steel coil prices. Zinc costs are very important. Watch these costs to guess when prices might change.

Buyers can handle price risks by using contracts to lock in prices. They can also use different suppliers. This helps stop sudden price jumps.

2025 Galvanized Steel Coil Prices

Price Trends

The galvanized steel coil market has prices that go up and down in 2025. Many experts say prices are not the same everywhere. The table below shows what some sources think prices will be for different products:

Source | Product Type | Price Range (per ton) |

The State of Steel April 2025 | Hot Dipped Galvanized (HDG) | $1,074 - $1,140 |

SMU price ranges | Galvanized .060” G90 benchmark | $917 - $1,017 |

SMU price ranges | Galvanized base prices | $870 |

In early 2025, prices for galvanized sheets changed in different places. Asia saw prices go up a little at the start of the year. There was not enough supply, and many people wanted coils for building and cars. This made prices rise. In the second quarter, zinc cost more, but fewer people needed coils for big projects. This made prices fall. Europe had higher prices at first because fewer coils came from other countries. People did not buy much, so experts are careful about the next few months. North America saw prices go up slowly. More building and making things helped prices stay strong, even when things were unsure around the world.

Premiums for galvanized steel coil changed a lot. The premium dropped to 20%, which is the lowest in three months. Last June, the premium was very high at 44%. This drop has lasted almost a year. It shows that the market and buyers are acting differently now.

Steel Prices Volatility

Steel prices for galvanized coil are not steady in 2025. Many things make prices change. People are not sure about buying, so they wait. This makes demand for steel lower. Big problems like inflation and higher costs from tariffs make the market shaky. Buyers hope prices will go down, so they wait to order. This waiting makes prices move even more.

Hot-rolled coil prices went up fast from $700 to $940 per ton early in 2025. This big jump shows how quickly prices can change. Tariffs made steel cost 30-40% more. These changes make it hard for buyers and sellers to set prices.

Many things make galvanized steel coil prices change:

Raw material costs like steel and zinc go up and down and change prices.

Making coils costs money for workers and energy, which affects prices.

When more people want coils for building or cars, prices go up. Prices also change with the seasons.

Rules about trading, like tariffs, make prices less steady.

Where suppliers are and how much buyers order matter. Buyers close to suppliers or who buy a lot get better deals.

The galvanized steel coil market in 2025 has many problems. Not enough supply, changing costs for materials, and energy prices all change how much coils cost. Buyers and others need to watch these things to know what prices will do next.

Galvanized Steel Coil Market Overview

Market Size and Growth

The galvanized steel coil market is getting bigger in 2025. Experts think it could be worth about $105.7 billion by the end of the year. This is because more people want galvanized steel coil in many industries. The market keeps growing every year. Experts say it could grow by 5% to 7% each year from 2025 to 2032. Some reports even say it might grow by 9% each year. This is faster than before.

Some things help the market grow:

Construction and automotive companies need more galvanized steel coil.

More countries are spending money on new roads and buildings.

People want materials that do not rust, so demand goes up.

The supply of galvanized steel coil must match what people need.

The table below shows how the market could grow:

Year | Market Size (USD Billion) | CAGR (%) |

2024 | 98.5 | 5.8 |

2025 | 105.7 | 5.8 |

2032 | ~150 | 5-9 |

Note: The size and growth of the galvanized steel coil market can change in different places and industries.

Key Market Drivers

Many things affect the galvanized steel coil market in 2025. The most important reasons are:

More people want materials that do not rust for building and making things.

Cities are growing fast, especially in new countries, so they need more buildings.

Big projects around the world need more galvanized steel coil.

Car makers want stronger and longer-lasting materials, so they use more galvanized steel coil.

People have more money to spend, so more appliances and furniture are made with galvanized steel coil.

Trends in the industry also help the market grow:

Car companies want cars that are light and strong to meet new rules.

Many companies care about the environment. Galvanized steel coil can be recycled and lasts a long time, so it helps cut down on waste.

Solar and wind farms use galvanized steel coil because it is strong and can handle bad weather.

Makers of home appliances and furniture pick galvanized steel coil because it looks good and works well.

Farms use galvanized steel coil for machines and buildings, which helps them work better.

The galvanized steel coil market keeps getting bigger because of these reasons and trends. How much material is available and if companies can keep up with demand will decide how big the market gets in the next few years.

Price Drivers

Raw Materials and Energy

Raw materials and energy costs are very important. In 2025, zinc and cold-rolled coil prices affect how much galvanized steel coil costs. The table below shows how these materials change prices:

Raw Material | Cost Impact | Expected Price Increase in 2025 |

Zinc | 3%-5% | 3%-8% increase in PPGI prices |

Cold-rolled coil | 2%-5% | 3%-8% increase in PPGI prices |

Energy is a big part of making steel. It is about 15% of the total cost. When energy prices go up, steel makers often raise their prices. Sometimes they add extra charges. In Europe, gas prices are now more than eight times higher. Electricity costs are five times higher because of the energy crisis. These changes make galvanized steel coil cost more for everyone.

Energy prices can change fast and affect costs.

Higher energy prices mean it costs more to make steel.

Companies may charge more to cover these costs.

Supply and Demand

Supply and demand decide how the market works in 2025. Trade rules and tariffs make prices and supply different for local and imported products. Many companies now use local suppliers. They also try new ways to make and coat steel. Customers want better coils that last longer. Producers use new technology to help with this.

Problems in the supply chain make getting coils harder. Delays at ports and changing demand slow things down. Construction and car makers want suppliers who deliver fast and keep good inventory. Tensions between countries and tariffs make it hard to get zinc and steel scrap. This made steel prices in the U.S. go up over 50% from 2020 to 2022. Companies now look for more suppliers and manage their stock better so they do not run out.

Regulations

Regulations change how companies make and price galvanized steel coil. New rules for the environment mean factories must lower pollution. Companies spend money on new technology to follow these rules. These costs usually get added to the price buyers pay. Some places have fewer rules, so prices may be lower there. But more countries care about the environment now. Price differences are getting smaller. The market must keep up with these changes to stay strong.

Regional Market Analysis

Asia-Pacific

Asia-Pacific is the top region for galvanized steel coil. By 2029, it could make up about 68% of all market money. Many cars and buildings need galvanized steel coil here. Cities and factories are growing fast. This helps the market get bigger. In 2024, Vietnam has more than 37.7% of the South East Asia market. Asia-Pacific needs more galvanized steel coil than other places. Prices in 2025 might go up as more companies build things. The market grows quickly because cities and industries keep getting bigger.

Europe

Europe’s market for galvanized steel coil is growing slowly. It could go from $20 billion in 2024 to $30 billion by 2033. This means it grows about 5.2% each year from 2026 to 2033. Prices in 2025 change for many reasons:

More factories could make too many coils.

Companies compete a lot.

Zinc and steel prices change often.

Cheap coils from Asia change local prices.

Rules for the environment cost extra money.

Green buildings and new cars also change the market. Europe’s need for coils stays steady. Prices change because of supply and rules.

North America

North America’s market is getting bigger, but not as fast as Asia-Pacific. More cars are being made, so demand goes up. In 2025, the U.S. might see a small rise in need. Canada will stay about the same. Mexico could grow by 4%. Fixing roads and energy projects help the market. Prices may stay the same or go up a little. It depends on how much steel car makers and builders want.

Other Regions

Other places like the Middle East, Africa, and Latin America have smaller parts of the market. New roads and growing factories make more people want galvanized steel coil. These regions together have about 12% of the world market. They are growing, but not as fast as Asia-Pacific or Europe.

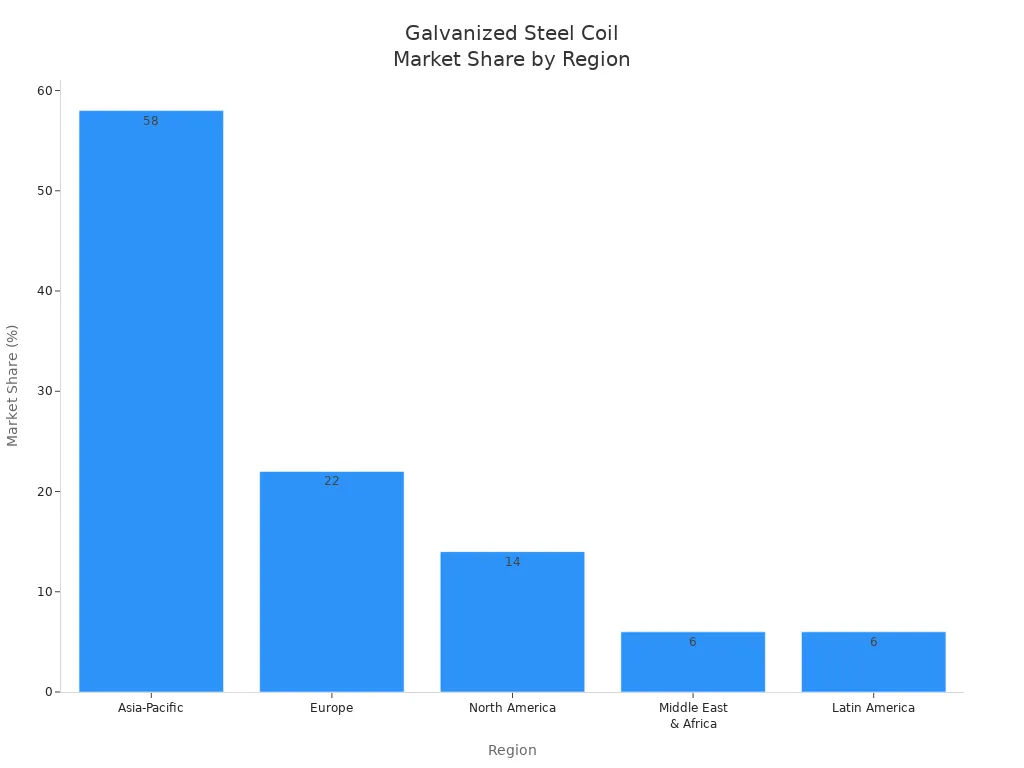

Region | Market Share (%) | Key Influences |

Asia-Pacific | >58% | Strong manufacturing, more buildings, more cars |

Europe | ~22% | Green building rules, new car ideas |

North America | ~14% | Fixing roads, energy projects |

Middle East & Africa | ~6% | New public projects, bigger factories |

Latin America | ~6% | New public projects, bigger factories |

Note: Different regions have different needs and supplies. This changes prices in the galvanized steel coil market. Asia-Pacific is the main place for growth in 2025.

Sectoral Demand Outlook

Construction

The construction sector uses the most galvanized steel coil. Builders pick it because it does not rust and lasts long. In 2024, the market for this material in buildings was $32.6 billion. Experts think this number will grow by 5.3% each year until 2035. By then, the market could be $57.2 billion. Builders use galvanized steel coil for roofs, walls, and frames. Cities keep getting bigger, so new homes and bridges need strong materials. Renovation projects also use galvanized steel coil to help old buildings last longer.

Builders use galvanized steel coil for many building parts.

Cities grow, so more buildings need strong materials.

Renovations use galvanized steel coil to fix old buildings.

The construction industry needs a lot of galvanized steel coil. This will keep happening as more people move to cities and need new buildings.

Automotive

Car makers use galvanized steel coil for many car parts. They use it for car bodies, frames, and doors. This material keeps cars safe from rust and damage. When more people buy cars, the need for galvanized steel coil goes up. The automotive sector uses advanced galvanized steel to make cars lighter and safer. Higher incomes let more people buy new cars. Car companies want materials that meet safety and environmental rules. Car makers also try to make cars last longer. Galvanized steel coil helps them do this.

Car makers use galvanized steel coil for car bodies and doors.

More people buy cars when they have more money.

Car companies want safe and strong materials.

Manufacturing

Manufacturing companies use galvanized steel coil for appliances, furniture, and machines. Fast city growth and more factories in Asia Pacific make these products needed more. Factories use galvanized steel coil to make washing machines, refrigerators, and shelves. New technology makes galvanized steel coil better, so more companies use it. Companies fix and upgrade old equipment, so they buy more galvanized steel coil.

Factories use galvanized steel coil for many products.

New technology makes galvanized steel coil better.

Companies buy more to repair and upgrade equipment.

The manufacturing sector likes galvanized steel coil because it is strong and does not rust. This helps products last longer and work better.

Competitive Landscape

Major Players

Some companies are the leaders in the galvanized steel coil market in 2025. They can make a lot of coils and sell them all over the world. These companies help decide what prices will be. The table below lists the top companies by how much of the market they have:

Rank | Company Name |

1 | ArcelorMittal |

2 | Nippon Steel Corporation |

3 | Tata Steel |

4 | POSCO |

5 | China BaoWu Steel Group |

6 | Gerdau |

ArcelorMittal has the biggest part of the market. Nippon Steel, Tata Steel, and POSCO are also very important. China BaoWu Steel Group and Gerdau are strong in Asia and the Americas. These companies spend money on new technology and add more products to stay ahead.

Market Segmentation

The galvanized steel coil market is split by product type and how people use it. There are hot-dipped galvanized coils and electro-galvanized coils. Hot-dipped coils are most used because they do not rust easily. Electro-galvanized coils are smooth and good for things like appliances and electronics.

People use galvanized steel coil in different ways. Construction uses the most for roofs, walls, and frames. Car makers need coils for car bodies and other parts. Factories use coils to make appliances, furniture, and machines.

Note: Each group needs something different. Companies make special products for each group.

Innovation and Strategy

Big companies work hard to make better products. They create new coatings that last longer and protect more. Many use machines and computers to make things better and cheaper. Some companies use green technology to follow new environment rules.

Companies also work together and move into new places. They change their plans to fit what people want in each area. By making many kinds of products, they help lots of industries and keep their place in the market.

Top companies use smart ideas and new technology to stay strong in the galvanized steel coil market.

The galvanized steel coil market in 2025 is growing fast. Prices change because of raw material costs, energy, and supply problems. Asia-Pacific has the most demand for coils. Construction and car companies use the most coils. Buyers need to watch zinc and energy prices. They should look out for new rules. It is important to have good suppliers.

Knowing what is happening in the market helps companies make good choices and change quickly.

FAQ

What is galvanized steel coil used for?

Galvanized steel coil works well in construction, automotive, and manufacturing. Builders use it for roofs and walls. Car makers use it for body panels. Factories use it for appliances and machines.

Why do galvanized steel coil prices change so much?

Prices change because of raw material costs, energy prices, and supply problems. Tariffs and new rules also affect prices. Demand from construction and car companies can make prices go up or down.

How does zinc affect galvanized steel coil?

Zinc protects steel from rust. When zinc prices rise, galvanized steel coil becomes more expensive. Zinc also makes the coil last longer in harsh weather.

Which region has the biggest demand for galvanized steel coil?

Asia-Pacific leads the world in demand. Many factories and building projects need galvanized steel coil there. Cities in this region grow quickly, so they use more steel.

How can buyers manage price risks?

Buyers can watch market trends and lock in prices with contracts. They can also work with several suppliers. This helps them avoid sudden price jumps.