Galvanized steel coils will probably have a small price increase in 2025. Experts think the world market will be worth $35.61 billion. The yearly growth rate is expected to be 3.17%. The price path is still not clear. Prices have changed a lot before. For example, extra costs have been between $170 and $310 per short ton in the last few years. In July 2022, the extra cost was a record 52%. Companies like

Sino Steel need to know about these changes. This helps them make good choices about buying and planning money.

Year | Market Size (USD Billion) | CAGR (2025-2035) |

2024 | 34.52 |

|

2025 | 35.61 | 3.17% |

2035 | 48.66 |

|

Time Period | Price Premium (USD/st) | Percentage Premium (%) |

May 2023 | $170 | 20% |

March 2023 | $310 | 44% |

Last Year | $207 (avg) | 38% |

Pre-pandemic (2017-2021) | $85-220 | 24% (avg) |

July 2022 | 52% (record high) |

|

Key Takeaways

Galvanized steel coil prices may go up a little in 2025. The price might be between $900 and $1,200 for each short ton.

The cost of raw materials affects the price a lot. Zinc and steel are very important for the final price of galvanized steel coils.

Companies should watch global events and energy prices. This helps them make smart choices when buying and controlling costs.

Making good connections with suppliers is helpful. Using long-term contracts can lower risks from changing prices.

Construction and automotive industries use the most galvanized steel coils. They help create demand and change market trends.

Galvanized Steel Coil Price Trends in 2025

Market Forecasts and Expected Ranges

Experts think galvanized steel coil prices will go up a little in 2025. Prices will probably be higher than before the pandemic. Construction, automotive, and manufacturing will keep needing these products. These industries use galvanized steel coil and galvanized steel sheet a lot.

In 2025, prices might be between $900 and $1,200 per short ton. This price range matches what is happening in the market now. It also matches what people expect for raw material costs. Zinc and steel prices will be very important for the final price. If energy costs go up, prices may rise more. Companies should watch these things to make smart choices.

Note: The 2025 price outlook is good, but prices could still change. If companies stay updated, they can react fast to new market news.

Volatility and Key Turning Points

Galvanized steel coil prices can change fast. Many things can make prices go up or down:

Raw material costs, like zinc and cold-rolled coil, can change quickly.

Energy prices are hard to predict and can make production cost more.

Supply and demand can shift because of construction and automotive needs.

New rules or tariffs can make the market less certain.

Trade policies and tariffs can also make prices less stable.

Past events show prices can move a lot. The table below shows some big changes and what happened:

Event | Impact on Prices |

Elevated Interest Rates | Made it cost more to borrow money, so less was spent on galvanized steel. |

Global Supply Chain Disruption (2022) | Problems in supply chains made prices change a lot. |

COVID-19 Pandemic (2019-2020) | Demand dropped in HDG-heavy industries, so prices went down. |

Global Economic Downturn (2019-2020) | Less demand in steel and automotive meant lower prices. |

These events show that prices can change a lot if the world economy, supply chains, or rules change. In 2025, new events could also change prices. Companies should watch out for these risks and be ready to adjust their plans.

Recent years show that watching raw material costs, energy prices, and world events helps companies avoid problems. If buyers and sellers know what is happening, they can make better choices.

As things change, companies like Shandong Sino Steel Co., Ltd. keep giving customers good galvanized steel coils and other products. Their skills in making, processing, and sending products around the world help customers deal with market changes. Shandong Sino Steel Co., Ltd. works hard to be creative and help customers make smart choices for 2025 and later.

Main Drivers of Price Trends

Raw Material Costs: Steel and Zinc

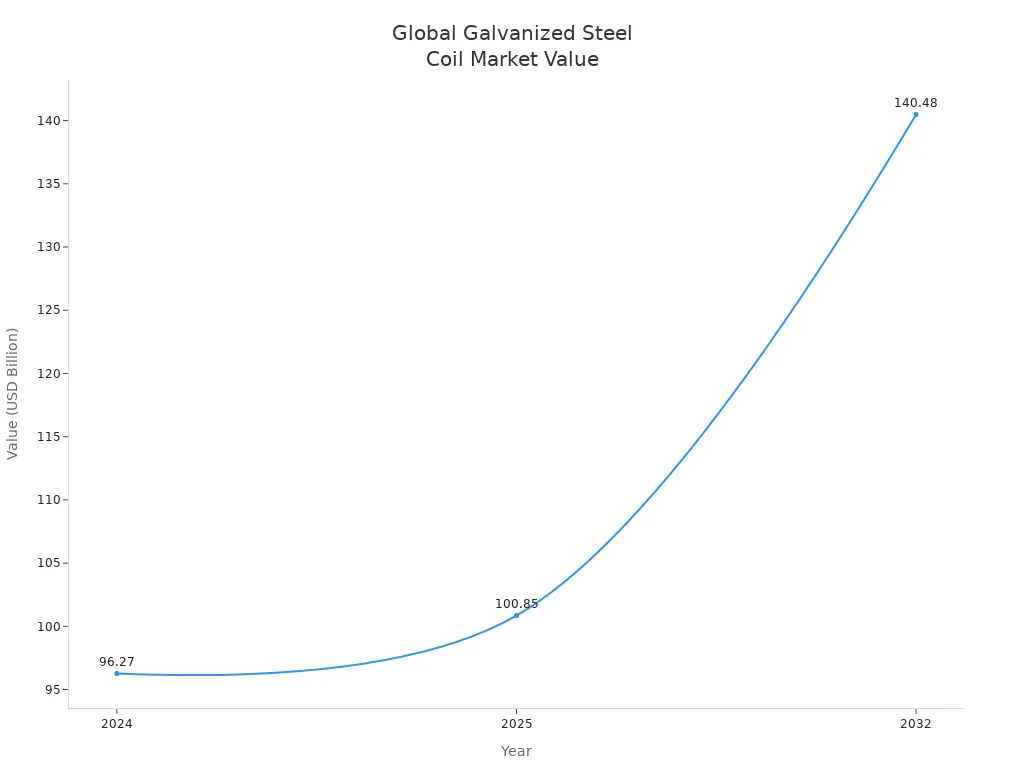

Raw material costs are very important for prices. Zinc is used to coat galvanized steel coils. When zinc costs more, making coils costs more. This means buyers pay higher prices. If zinc gets cheaper, manufacturers can lower prices. Steel prices also matter a lot. Hot-rolled coil steel was $830.07 per ton. That is 23.52% more than last year. This happened even though prices dropped recently. The table below shows how steel and zinc values may grow worldwide:

Year | Global Value (USD Billion) | CAGR (%) |

2024 | 96.27 | - |

2025 | 100.85 | 4.83 |

2032 | 140.48 | - |

Global Demand and Market Trends

The market for galvanized steel coil is growing steadily. Different industries change how much is needed. Construction uses the most, with 45% of demand. Automotive comes next with 25%. Appliances, renewables, and other industries also need coils. The market could reach $145 billion in 2025. It was $130 billion in 2023. More cities, green buildings, and electric cars help demand grow. The chart below shows how the market is growing:

Geopolitical and Energy Impacts

World events and energy costs make prices change a lot. Trade rules and tariffs can make supply smaller and prices higher. Zinc and aluminum prices change because of mining and energy markets. Oil and gas costs are a big part of making coils. When energy costs go up, making coils costs more. New environmental rules can make it cost more to follow laws. Manufacturers often add these costs to what buyers pay.

Supply Chain and Logistics

Problems with supply chains and shipping affect prices. Delays and crowded ports make it hard to get materials and products. World tensions, tariffs, and trade rules change how things are shipped. This can cause shortages in some places. The table below shows how much each cost part adds to the final price:

Cost Component | Percentage Contribution |

Base steel substrate | 60–70% |

Zinc coating materials | 15–20% |

Energy and labor | 5–10% |

Logistics, packaging, admin | 5–10% |

Note: Companies like Shandong Sino Steel Co., Ltd. use strong processes and good shipping to help customers handle price changes and get products in 2025.

Sectoral Demand for Galvanized Steel Coils

Construction Market Trends

The construction industry uses a lot of galvanized steel coils. Many things affect this need:

The world market for galvanized steel might reach $155 billion by 2026. This means it is growing fast.

Builders care more about the environment now. They pick materials like Galvalume steel coil because it is strong, easy to shape, and can be recycled.

Aluzinc-coated buildings last longer and cost less over time. This fits with the construction industry’s goal to be more eco-friendly.

Big building projects use a lot of steel. About 40% of all steel in the world is used for infrastructure. Public projects like bridges, railways, and pipelines use galvanized parts about 55% of the time.

Application Area | Usage in Construction |

Cladding | High |

Roofing | High |

Structural Framing | High |

Cities are growing, and governments spend more on new buildings. This makes people want more materials that do not rust. Hot-dip galvanized steel coils are still very important in making steel products.

Automotive Sector Outlook

The automotive industry will use more galvanized steel coil in 2025. Car makers want cars to be lighter by 10-15% to follow emissions rules. Because of this, Galvalume steel use has gone up 18% each year since 2021. Electric cars need to be light so batteries last longer, so they use more galvanized steel sheet. These changes make prices go up as companies look for better materials.

Manufacturing and Other Industries

Factories and other businesses also need galvanized steel coils. In 2025, more building and big projects in cities and the countryside will make demand higher. As the car industry grows, more cars need strong, rust-resistant steel. Stricter rules for the environment mean companies use safer coating methods, which leads to new ideas. All these things affect prices and give helpful information to buyers and sellers.

Companies can use this information to get ready for price and demand changes in 2025.

Shandong Sino Steel Co., Ltd. helps these industries with many kinds of steel products. The company sells high-precision galvanized steel coils, galvalume steel coils, and galvanized steel sheet. Shandong Sino Steel Co., Ltd. has a full process and strong factories, so it sends good products to over 200 countries. Their skills and hard work help customers handle price changes and meet needs all over the world.

Regional Market Trends for Galvanized Steel Coils

Asia-Pacific Outlook

Asia-Pacific uses more galvanized steel coils than any other place. In 2024, this region has over half of the world’s market. The market here is growing very fast. Experts think it will grow by 6.67% each year from 2024 to 2030. Many countries help this growth, and each one is strong in different ways.

Key Factors Driving Growth | Countries Leading Growth |

Urbanization | China |

Infrastructure Development | Australia |

Technological Advancements | Japan |

Demand in Construction | South Korea |

Demand in Automotive | Vietnam |

Demand in Appliances |

|

The world market for galvanized steel could be $145 billion in 2025.

More people living in cities, green energy, and new ways to make things all help demand go up.

Because Asia-Pacific is growing so fast, prices might go up faster here than in other places.

Europe: Price Trends and Challenges

Europe has some special problems that change galvanized steel coil prices. In 2023, the European Union started the Carbon Border Adjustment Mechanism. This rule makes companies pay more if they move work to places with weaker carbon laws. This can make galvanized steel sheet cost more. Other things also matter:

Tough rules and extra costs make prices go up.

Changes in the economy can make people buy more or less.

Other materials can compete and slow down growth.

Europe cares a lot about green rules and carbon costs. This will probably keep prices higher than in some other places.

North America: Demand and Price Pathways

North America keeps needing galvanized steel coils. Many things help this happen:

Governments and companies spend money on new roads and buildings.

Car makers use more light materials like galvanized steel coil.

Rules about being green make people use things that can be recycled.

New ways to make things help make better products and lower costs.

Builders use galvanized steel coils for roofs and walls because they do not rust. Car makers like them because they are strong and light. These things mean prices will likely stay the same or go up a little in 2025.

Other Key Regions

Latin America, the Middle East, and Africa together have about 12% of the world’s market. New public projects and bigger factories make more people want galvanized steel coil. But these places are not growing as fast as Asia-Pacific or Europe. Prices may not go up as quickly, but new projects give sellers chances to grow.

Companies that work all over the world, like Shandong Sino Steel Co., Ltd., can help customers in every region. Their many products and strong shipping help buyers deal with different prices and needs in 2025.

Managing Price Risks and Opportunities

Volatility Risks and Mitigation

Galvanized steel coil buyers have many risks in 2025. Prices can change fast because of supply chain problems, tariffs, and demand changes. The table below shows some important signs of recent price swings:

Indicator | Value |

Manufacturing PMI | 49.0% |

HRC Price (January) | $700/ton |

HRC Price (April) | $940/ton |

Galvanized Sheet Price | >$1,100/ton |

Steel Cost Increase | 30-40% |

Many OEMs and fabricators wait to order, hoping prices drop. Some buyers stop buying for now, causing a 'buyer's strike.' Tariffs have made steel products cost 30-40% more. Companies must choose to pay these costs or raise prices for customers. This makes the market harder to predict.

To handle these risks, companies use different plans:

Add automatic price changes to contracts. This helps if prices move up or down.

Get supplies from more than one place to avoid problems.

Use financial tools like forward contracts and indexed pricing to keep costs steady.

These steps help companies deal with sudden changes and keep things running smoothly.

Strategies for Buyers and Stakeholders

Buyers and stakeholders can take steps to protect themselves and find new chances in 2025. Here are some simple strategies:

Make strong partnerships with suppliers. This keeps quality good and protects profits.

Be open about prices, delivery times, and inventory. This helps buyers plan and avoid surprises.

Buy materials from local sources when possible. Local buying can save money if tariffs make imports cost more.

Get supplies from different places to lower the risk of shortages.

Use hedging and long-term contracts to control raw material price changes.

Work closely with shipping and raw material suppliers to make the supply chain stronger.

Train workers on new machines and quality checks.

Stay flexible in making products to handle changes in tariffs and demand.

Companies like XYZ Steel Service Center use forward contracts and indexed pricing to get better deals, even when prices change. By using these strategies, buyers can turn risks into chances and get ready for the future.

Shandong Sino Steel Co., Ltd. helps customers with many steel products and services. The company sells high-precision galvanized steel coils, galvalume steel coils, and prepainted steel coils. With a full process and strong partnerships, Shandong Sino Steel Co., Ltd. helps clients manage price risks and meet changing needs in over 200 countries. The company works hard to give high-quality products and build long-term, win-win relationships around the world.

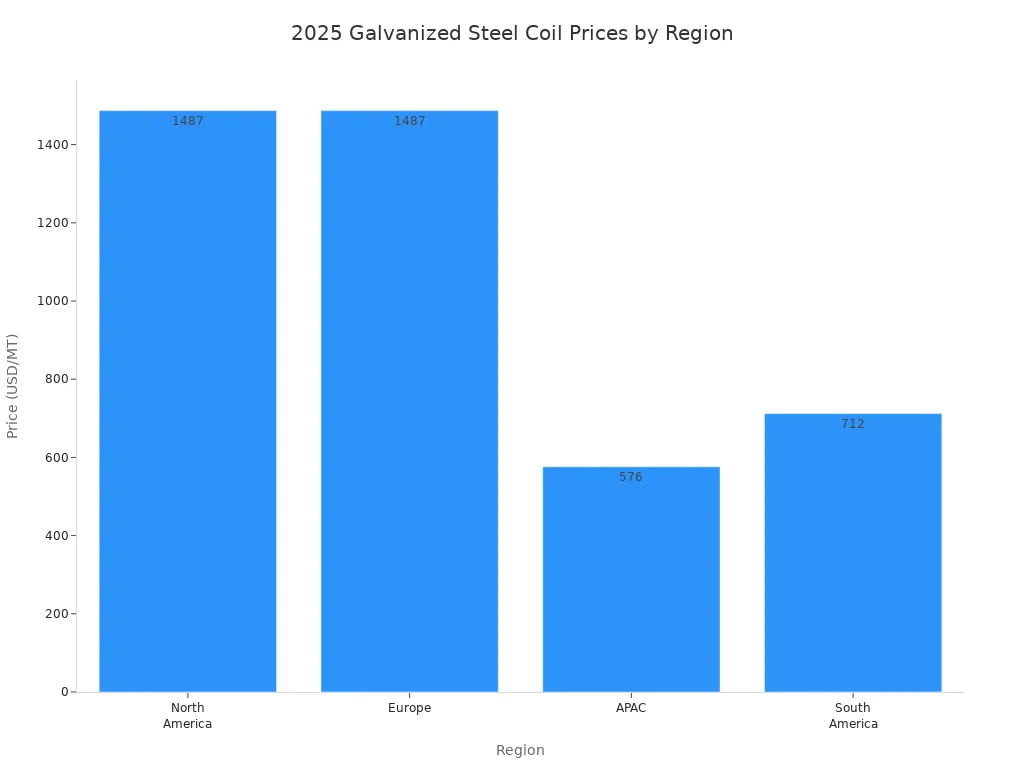

Price trends for galvanized steel coils in 2025 are different in each region. North America and Europe have prices close to $1,487 per metric ton. APAC has lower prices at $576 per metric ton. The table below shows these price differences and what causes them:

Region | Price (USD/MT) | Price Change | Key Influences |

North America | 1,487 | +2.5% | Demand recovery, rising raw material costs |

Europe | 1,487 | Increasing | Improved sentiment, supply tightness |

APAC | 576 | Moderate | Stabilizing demand, geopolitical tensions |

South America | 712 | Moderate | Strong automotive demand, import tariffs |

Companies see prices go up and down a lot. They should get steel from many places. Using data helps them make smart choices. Building up extra stock can help if prices change. Watching price trends lets buyers get ready for changes and spot new chances.

Shandong Sino Steel Co., Ltd. makes and sells lots of steel products. The company has galvanized steel coils, prepainted steel coils, and more. It has big factories and sells to many countries.

FAQ

What makes galvanized steel coils different from regular steel coils?

Galvanized steel coils have a zinc layer. This layer keeps the steel from rusting. It also stops damage. Regular steel coils do not have this layer. Many industries pick galvanized coils because they last longer.

Why do prices for galvanized steel coils change so often?

Prices change for many reasons. Raw material costs go up and down. Energy prices also change a lot. World events can make prices move. Problems in supply chains matter too. New rules can affect prices. Companies watch these things to plan better.

Which industries use galvanized steel coils the most?

Construction uses lots of galvanized steel coils. Automotive and manufacturing use them too. Builders use coils for roofs and walls. Car makers use them for strong, light parts. Factories use them for machines and tools.

How can buyers reduce risks when prices go up?

Buyers can sign long-term contracts. They can buy from different suppliers. Watching market trends helps too. These steps help control costs. They also help avoid shortages. Good planning keeps companies strong when prices change.