Understanding the Global Landscape of Galvanized Steel Coil

The galvanized steel coil industry has entered a phase of accelerated transformation driven by global infrastructure development, manufacturing expansion, and rising demand for corrosion-resistant materials. As industries place stronger emphasis on durability and cost-effective metal solutions, galvanized steel coil remains one of the most relied-upon materials in construction, automotive manufacturing, home appliances, and industrial fabrication.

While steel markets have historically fluctuated due to economic cycles, the long-term outlook for galvanized steel coil shows consistent growth. Factors such as urbanization, stricter material standards, and technological improvements in coating processes are reshaping how mills produce and deliver galvanized products. This article provides a deep evaluation of the key forces influencing the market, current trends, and a forward-looking industry forecast through 2025 and beyond.

Market Fundamentals of Galvanized Steel Coil

What Defines Galvanized Steel Coil?

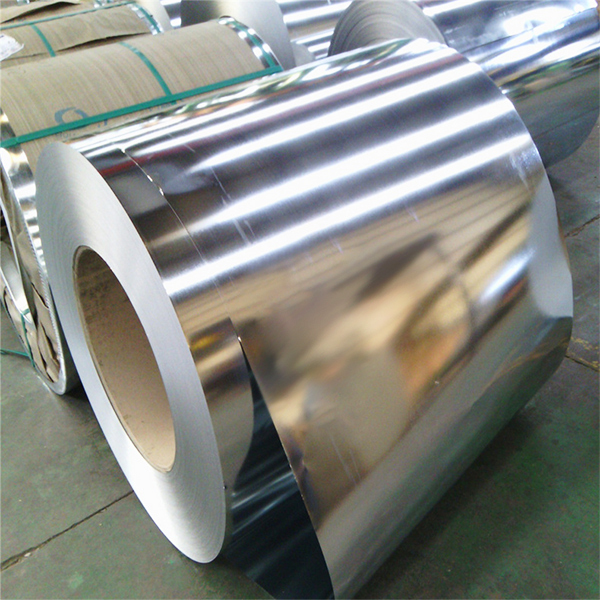

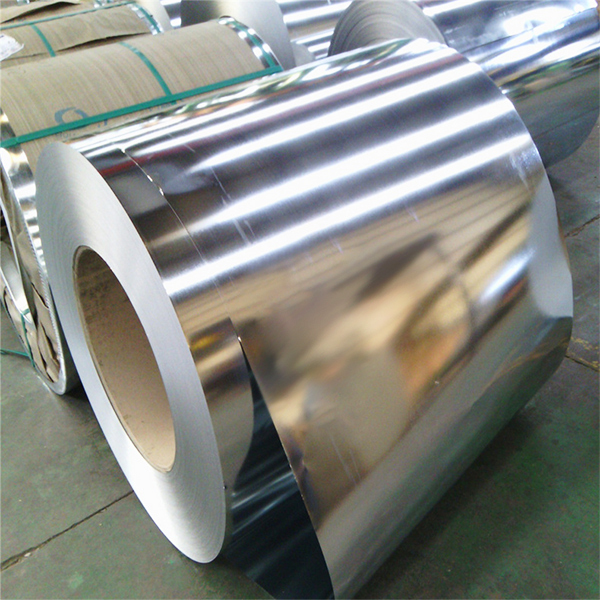

Galvanized steel coil is produced by coating cold-rolled steel with a layer of zinc, forming a barrier that protects the underlying metal from rust and environmental degradation. Its stability, high tensile strength, and long service life make it an essential material across global industries.

Why the Material Continues to Dominate

Unlike traditional steel, galvanized steel coil benefits from:

Superior corrosion resistance

Favorable cost-to-performance ratio

High adaptability to forming, welding, and painting

Consistent quality across mass production

These advantages ensure that demand remains strong even during market fluctuations.

Key Drivers Fueling Market Expansion

Rising Demand in Construction

The construction sector accounts for the largest share of galvanized steel coil consumption. As urban populations continue to grow, the need for durable roofing, cladding, structural components, and HVAC systems increases. Because galvanized components perform reliably even in humid, coastal, or industrial environments, they are favored for both residential and commercial applications.

Infrastructure Investments in Emerging Economies

Asia-Pacific, Africa, Latin America, and the Middle East are experiencing fast-paced development. National programs focusing on railways, energy plants, industrial parks, and transportation networks are accelerating steel consumption. Galvanized steel coil usage in these regions is predicted to grow steadily, supported by government-backed infrastructure initiatives.

Automotive Industry Shifting Material Standards

Lightweight Yet Protective Materials

Automotive manufacturers increasingly require corrosion-protected steel that balances strength and weight. Galvanized steel coil satisfies both criteria, particularly for body panels, frames, and underbody components.

EV Market Expansion Boosting Steel Demand

Electric-vehicle manufacturers emphasize longer product lifespans and strict safety requirements. Galvanized steel coil’s improved durability supports battery housing frames, safety elements, and various reinforcement components.

Home Appliances and Domestic Manufacturing Growth

Demand for Consumer Goods

Appliances such as refrigerators, washing machines, ventilation systems, and heating units utilize galvanized steel to improve lifespan and reduce susceptibility to moisture or abrasion.

Supply Chain Localization

Many countries now encourage domestic manufacturing to reduce import dependency. As a result, more appliance factories are sourcing galvanized steel coil from local mills and distributors, supporting consistent global market expansion.

Technological Advancements Improving Product Quality

Enhanced Coating Uniformity

New coating lines allow for precise zinc thickness control, resulting in higher product stability and better corrosion performance.

Eco-friendly Production Innovations

Environmental regulations worldwide are pushing steel mills to adopt:

This results in greener galvanized steel coil production, meeting international standards.

Integration of Digital Manufacturing

Smart factories using automation, optical inspection systems, and AI-supported quality assessments can now produce galvanized steel coil with higher accuracy and traceability.

Impact of Global Trade and Economic Conditions

Trade Agreements and Steel Tariffs

Steel remains one of the most heavily regulated materials in global commerce. Policies affecting imports and exports alter supply flows, influencing regional pricing and availability.

Currency Fluctuations and Raw Material Prices

Zinc pricing significantly impacts galvanized steel coil costs. Fluctuations in global zinc markets can raise or lower production expenses, affecting mill quotations and distributor pricing.

Regional Market Insights

Asia-Pacific Leads Global Production

China, India, South Korea, and Japan remain dominant producers due to large-scale steel mills and competitive production costs. Massive infrastructure programs in Asia ensure steady demand through 2030.

North America and Europe Prioritize High-Quality Materials

Stringent building requirements and high manufacturing standards drive demand for premium galvanized steel coil. Automotive and industrial applications remain key drivers in these regions.

Middle East Demand Rising for Structural Projects

Major construction and energy-related initiatives have boosted steel purchases, especially galvanized coil for industrial installations and metal building components.

Market Forecast and Growth Outlook

Expected Growth Rate Through 2030

Industry analysts project sustainable expansion of the galvanized steel coil market, supported by:

Replacement of aging infrastructure

Long-term construction growth

Increasing manufacturing capacity

Technological improvements in galvanizing lines

Globally, galvanized steel coil consumption is expected to rise annually as industries demand materials with longer service life and reduced maintenance costs.

Shifts in Material Preferences

While aluminum and stainless steel continue gaining traction in some sectors, galvanized steel coil remains the preferred cost-efficient option for most large-scale projects.

Challenges and Risks in the Market

Volatility in Raw Material Supply

Fluctuating zinc and steel prices can affect mill profitability and supply stability.

Competition from Alternative Materials

Composite panels and coated aluminum products are emerging as substitutes in certain applications.

Environmental Compliance Pressures

Producers must invest heavily in cleaner technologies, increasing overall production costs.

Strategic Opportunities for Manufacturers and Distributors

Expansion into High-Growth Regions

Companies that establish distribution networks in emerging markets can access fast-growing demand.

Product Diversification

Adding options such as galvalume, prepainted coils, or special-grade galvanized coil helps meet specialized industry needs.

Strengthening Supply Chain Logistics

Improved warehousing and transportation services provide competitive advantages, especially during volatile market conditions.

Why High-Quality Galvanized Steel Coil Matters

As industries continue to prioritize stronger, more reliable materials, galvanized steel coil remains indispensable. Its versatility across building, mechanical manufacturing, and large-scale infrastructure ensures that the material will remain central to the global metal supply chain for years ahead.

Company Highlight: Reliable Supplier of Galvanized Steel Coil

At Shandong Sino Steel Co., Ltd., we supply galvanized steel coil with stable quality, uniform zinc coating, and strict surface control. With a complete production chain—from cold-rolled base material to advanced galvanizing and surface finishing—we provide consistent, high-performance products tailored to construction, appliance manufacturing, and industrial usage.

Our strong logistics network, dependable inventory supply, and professional export experience allow us to support customers worldwide with long-term, reliable galvanized steel coil solutions.

FAQs

1. What industries use galvanized steel coil most frequently?

Construction, automotive, home appliances, HVAC manufacturing, and general fabrication rely on galvanized steel coil due to its corrosion resistance and durability.

2. How long can galvanized steel coil last in outdoor environments?

Depending on zinc thickness and exposure conditions, galvanized steel coil can last several decades with minimal maintenance.

3. Is galvanized steel coil cost-effective for large projects?

Yes. Its balance of strength, corrosion resistance, and affordability makes it one of the most economical materials for high-volume applications.

4. What affects the price of galvanized steel coil?

Zinc prices, steel costs, production processes, and regional supply-demand dynamics are major pricing factors.

5. Do coated steel alternatives threaten galvanized steel coil demand?

While alternative materials exist, galvanized steel coil maintains strong market dominance due to its superior cost-performance ratio and widespread applicability.