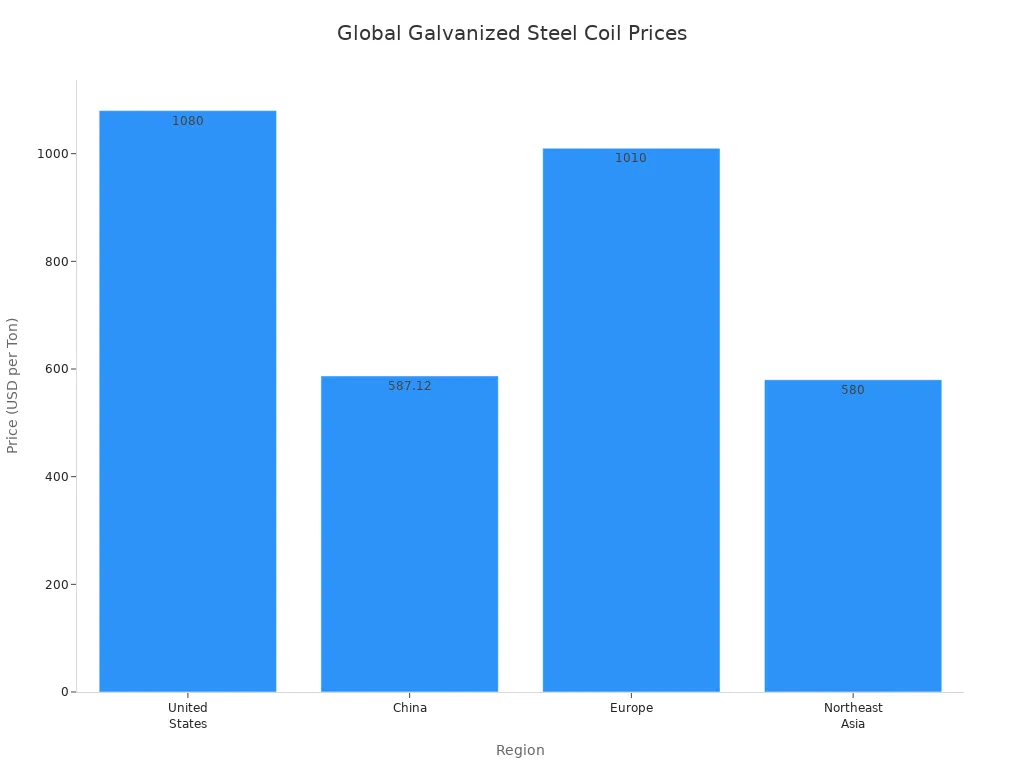

Galvanized steel coil prices have gone up a lot. This is because zinc and steel cost more now. Energy also costs more. There is strong demand from building and car companies. Zinc ingot prices in the USA hit $3,445 per metric ton in June 2025. This shows there are still supply problems. Factories still need a lot of zinc. Many buyers pay more because of tariffs. Trade rules are also changing. The table below shows the latest prices:

Region | Price (USD per Ton) | Date |

United States | $1,080 | July 2024 |

China | $587.12 | July 2024 |

Europe | $1,010 | Jan 2025 |

Northeast Asia | $580 | Jan 2025 |

Sino Steel and other big producers are making changes. Buyers are trying to deal with a market that changes a lot.

Key Takeaways

Galvanized steel coil prices are going up because zinc, steel, and energy cost more now. Buyers need to watch these prices often.

The construction and automotive industries want more galvanized steel. This makes the need for it higher. Companies should get ready for more growth in these areas.

Trade rules and tariffs can change prices a lot. Buyers need to know about new trade policies. This helps them avoid surprise costs.

Good risk management, like having many suppliers and using flexible contracts, can help buyers handle price changes.

Planning for the future is very important. Knowing market trends and having good supplier relationships can help get better prices and steady supply.

Galvanized Steel Coil Cost Drivers

Zinc Price Surge

Zinc is very important for making galvanized steel coil. In the last year, zinc prices went down by 2.30%. The price was $3,059 per ton in late October 2025. Even though the price dropped a little, zinc still costs a lot for companies. Some things keep zinc prices high:

There is not much finished metal, so supply is tight and prices stay up.

Zinc oxide companies are making more because they think people will want more later.

China’s economy is getting help, so people buy more zinc.

Problems between countries and trade rules make prices change a lot.

Galvanized steel coil needs zinc to be made. When zinc prices go up or down, the cost to make coils changes fast. For example, in June 2025, galvanized plain sheet prices in the USA were $1,520 per metric ton. This shows that steady demand and zinc prices make costs higher.

Steel Market Fluctuations

Steel prices also change how much galvanized steel coil costs. In the last year, the price difference between hot-rolled coil and galvanized steel got bigger. In September, the gap was $175 per short ton, the highest in three months. Hot-rolled coil prices dropped by $95 per short ton since July. That is 11% less than three months ago. Galvanized steel prices fell by $90 per short ton since mid-June. That is 16% less than six months ago. The average gap last year was $179 per short ton. This is lower than the $205-240 range from the year before.

Some main things make steel prices change a lot:

The world’s economy changes how much steel people want and what it costs.

Problems like storms or fights between countries can make steel hard to get and raise prices.

Trade rules and tariffs change how much steel comes in or goes out, which changes prices at home.

The cost of things like zinc and steel changes how much it costs to make coils.

Energy prices change how much it costs to make steel and what people pay in the end.

Because of these changes, buyers need to watch the steel market all the time. When steel or zinc prices move, the cost of galvanized steel coil can go up or down fast.

Energy-Intensive Production

Making galvanized steel coil uses a lot of energy. Almost half of the cost to make it is from energy. Many companies say higher energy prices make it harder to work well. Over 40% of companies have these problems. More than 30% have trouble following emissions rules. About 26% have problems making their galvanizing lines work better.

Evidence Description | Percentage Impact |

Energy costs account for production expenses in galvanized steel coil manufacturing | Nearly 48% |

Manufacturers reporting operational inefficiencies due to rising energy prices | Over 40% |

Manufacturers facing challenges with emissions compliance | More than 30% |

Producers struggling with optimizing galvanizing line throughput | 26% |

When energy costs go up, it is harder for companies to keep prices the same. Higher energy prices mean galvanized steel coil costs more.

Transportation and Labor Costs

Moving and making galvanized steel coil costs money too. The price of hot-rolled coil and zinc is important, but so are shipping, energy tariffs, workers, and trucks. Getting steel from Asia and Latin America helps, but shipping prices can change fast. If there are not enough workers or if wages go up, it costs more to make steel. All these things make the market hard to guess.

Note: Buyers should watch shipping and worker costs. These can change fast and make galvanized steel coil cost more.

Supply and Demand Trends

Construction and Automotive Demand

The construction and automotive industries use a lot of galvanized steel coil. Construction uses more than 36% of all coils. Cities are growing fast. New buildings and roads need strong, rust-proof materials. Reports say the building materials market will be $57.2 billion by 2035. This is because more cities are being built. People also want products that last a long time.

The automotive industry needs more galvanized steel coil too. SUVs and crossovers are more popular now. These bigger cars use more steel. Cars have more safety parts, so they need extra steel. China and India make more cars every year. This means they need more steel coils.

The global galvanized steel coil market was worth $25.5 billion in 2023.

It could reach $64.5 billion by 2032, growing 11.25% each year.

China makes over 60% of the world’s galvanized steel. The United States made 12 million metric tons in 2022.

Asia Pacific uses the most, then North America, Europe, and the Middle East & Africa.

Inventory and Stockpiling

Companies sometimes buy and store extra galvanized steel coil. They do this when they think prices will go up. This can cause shortages and higher prices for a short time. If the housing market slows down, there can be too much supply. This makes prices drop. Builders and factories like lower prices. They can save money and make more profit. These savings might help them buy more and sell more.

Note: Inventory levels can change fast. Buyers should watch for stockpiling or too much supply. These things can change prices in the market.

Global Supply Chain Issues

Supply chain problems still make it hard to get galvanized steel coil. Factories have trouble keeping up after pandemic lockdowns. There are not enough materials to make enough steel. Steel prices have gone up by over 300% since before the pandemic. This makes supply chains less steady.

Not enough materials means less steel is made.

Factories cannot always meet demand as they try to make more.

Higher costs make it harder to manage the supply chain.

Problems with shipping slow down raw materials and finished products.

These problems can cause delays and price changes. Companies must plan well to avoid problems and keep costs low.

Trade and Geopolitical Impacts

Tariffs and Trade Barriers

Tariffs and trade barriers are important for galvanized steel coil prices. Countries use them to help their own businesses. When a country adds a tariff, imported steel costs more. This makes buyers pay higher prices.

Country | Measure Type | Affected Products | Duty Range (%) | Effective Date |

Egypt | Safeguard | Steel billet, cold-rolled and hot-dipped galvanized coil, pre-painted flat steels | 4.94 - 12.16% | 14 September (for 200 days) |

The United States put a 25% tariff on all steel imports. This made steel from the US cost more. In China, prices went down, so there was a price gap. Many US builders now use more steel made in the US. A survey found 40% of these companies use more US steel after tariffs.

Tariffs make imported steel cost more.

Local producers can do better with less competition.

Price gaps can happen between different regions.

Note: Buyers should watch for new tariffs or trade rules. These can change prices fast and affect supply.

Regional Policy Changes

Regional policy changes also affect the galvanized steel coil market. The Section 232 tariffs in the US doubled. This made imports drop a lot. Hot-dipped galvanized imports fell by 53.4% from last year. In August 2025, total steel imports were 1.325 million tons. This was 22.0% less than July and 27.7% less than August 2024. For the year, total steel imports dropped 7.0% from 2024. Finished steel imports fell by 10.6%.

Policy changes can lower supply and raise prices.

More steel from China, India, and Southeast Asia can mean too much supply and lower prices.

Asian companies compete, which can make prices drop.

China wants to cut extra supply and help the environment, which may keep prices steady.

North America and Europe have strict rules for the environment. These rules can help local companies even if imports go up.

Tip: Regional policies can change supply and demand. Buyers should keep up with changes in important markets.

Regional Price Differences

North America

Galvanized steel coil costs more in North America than other places. Many things make prices stay high. Factories take longer to fill orders. Buyers think prices will go up soon. The market is very active.

Galvanized coil prices are between $1,180 and $1,240 per net ton.

The average price is $1,210 per ton.

For galvanized .060” G90 coils, prices are $1,249 to $1,309 per ton. The average is $1,279 per ton.

Lead times are long, from 8 to 13 weeks. This makes planning hard.

Many buyers think prices will go up next month.

Tip: Buyers in North America should watch lead times and prices. Delays and higher costs can change project budgets.

Europe

Galvanized steel coil prices in Europe are lower than before. Market changes, new rules, and less demand are important reasons. Producers and buyers pay close attention to trade rules and material costs.

In 2024, the export price for flat-rolled steel coils in the EU was $849 per ton. This is 6.7% less than last year.

The import price was $823 per ton. This is 6.4% less than last year and 20.7% less than in 2022.

Prices were highest at $1,039 per ton in 2022. They have dropped since then.

In Northern Europe, hot-dipped galvanized coil prices are €670 to €700 per ton.

In Southern Europe, cold-rolled coil prices are going up. But buyers do not want to pay more.

Note: European prices show that people are careful. New rules and weak demand keep prices lower than in North America.

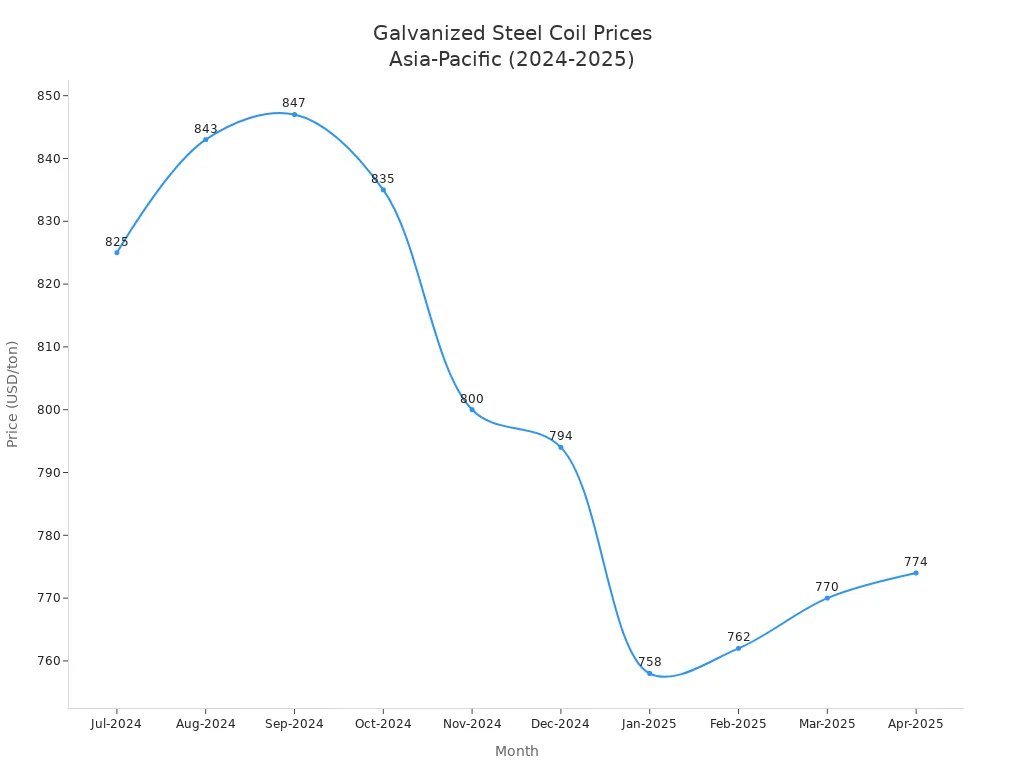

Asia-Pacific

Asia-Pacific is the biggest market for galvanized steel coil. Prices have stayed steady in the last few months. Fast growth in cities and factories means more people need steel. Construction and car companies use a lot.

Month | Hot Dipped Galvanised Coil Price (USD/ton) |

Jul-2024 | 825 |

Aug-2024 | 843 |

Sep-2024 | 847 |

Oct-2024 | 835 |

Nov-2024 | 800 |

Dec-2024 | 794 |

Jan-2025 | 758 |

Feb-2025 | 762 |

Mar-2025 | 770 |

Apr-2025 | 774 |

Asia-Pacific may make up about 68% of the world market by 2029.

Most demand comes from building and car companies.

More cities and new roads mean people use more steel.

New rules for the environment and higher costs could make prices go up later.

Tip: Asia-Pacific buyers should watch demand and new rules. These can change prices and supply very fast.

Buyer Guidance

Short-Term Strategies

Buyers see prices change quickly in the galvanized steel coil market. They can use some short-term plans to handle these changes. First, companies watch prices and news to see changes early. Second, they work with more than one supplier to avoid running out. Third, they use both long contracts and quick buys to get better prices. Fourth, data tools help them guess price moves and plan orders. Fifth, having good supplier ties helps get products when it is busy. Sixth, using recycled materials or saving energy can cut costs and lower risk.

Tip: Buyers who stay ready and flexible can act fast when the market changes.

Long-Term Planning

Long-term plans help buyers deal with rising prices. They must know what makes prices go up and how to get better deals. Some good ways are to learn what affects prices, like raw material costs and demand. They should get better at making deals for good contract terms. Setting up long contracts with trusted suppliers can keep prices steady. Improving the supply chain can help stop delays and save money.

Note: Buyers who plan ahead can stop sudden price jumps and keep projects moving.

Risk Management

Risk management keeps companies safe from big losses. Buyers can set clear budgets for buying steel. They use price guesses to plan spending. Keeping extra stock helps when things are unsure. They check contracts often to make sure they still work for the market.

A simple risk management table can help:

Risk Factor | Action Plan |

Price Volatility | Use flexible contracts |

Supply Disruption | Diversify suppliers |

Demand Changes | Monitor market trends |

Buyers who manage risk well can keep costs steady and avoid surprises.

Galvanized steel coil prices change because of zinc, steel, and energy costs. Market demand and supply chain problems also matter a lot. Trade rules can make prices go up or down. Buyers should watch these things closely. It is smart to stay ready for changes. Good buying plans help lower risk and keep costs down.

Knowing what is happening helps buyers pick the best options.

If you want a trusted partner, Shandong Sino Steel Co.,Ltd. can help. They sell many steel products like galvanized and prepainted coils. The company works with customers all over the world. They have strong factories and care about quality and service.

FAQ

What makes galvanized steel coil prices change so often?

Many things affect prices. Zinc and steel costs go up and down. Energy and shipping costs also change. Demand from building and car companies stays strong. Trade rules and supply problems can make prices move quickly.

How can buyers lower the risk of price jumps?

Buyers can use flexible contracts, watch the market, and work with more than one supplier. Keeping some extra stock helps during shortages.

Why do prices differ between regions?

Region | Main Reason for Price Difference |

North America | High demand, longer lead times |

Europe | Lower demand, new rules |

Asia-Pacific | Fast growth, steady supply |

What should buyers watch for in the market?

Buyers should check zinc and steel prices, energy costs, and shipping rates. They need to follow news about trade rules and supply chain issues. Watching these things helps buyers plan better.